Who doesn’t want to achieve financial freedom?

Your compensation can and should support your financial future. It’s time to break the cycle of salary dependence – a reliance that grows and even accelerates as your salary incrementally increases. Annual raises (although welcome!) tend to perpetuate the behavior to spend more when you earn more, rather than save for the long-term – making salaries and their growth false indications of true financial success.

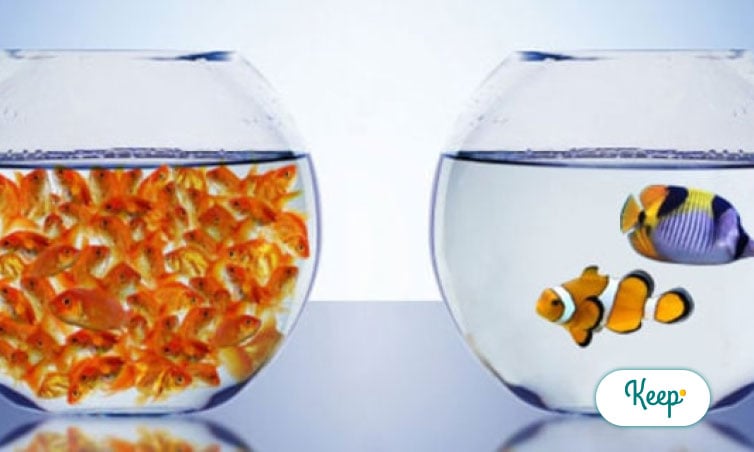

For the vast majority of employees, your annual salary is the cornerstone of your compensation and often how you benchmark your value in the market – and market yourself for promotion. It’s a primary reason why you choose to work for a specific company and a determining factor of whether you’ll stay (until another company offers a higher salary).

However, when your salary increases, it tends to lead to increasing your expenses – you can go out to dinner a few more times a month, get a new wardrobe, or buy that dining room table you’ve been eyeing because you’ll now be able to afford the monthly payments. Those things aren’t bad in and of themselves and in limited quantities, but what about the future? Planning for retirement? Paying down more of that seemingly never ending student debt?

When raises are small, it’s hard to think about saving them. And how much impact can a few hundred dollars per month really have on your long-term wealth generation? Not as much as a lump sum bonus.

To transform personal financial situations and develop true wealth creation and financial freedom, the focus needs to be on paying off debt, preparing for financial emergencies, saving for the future, investing for retirement, and so on.

And according to research, real change to personal finances comes when people are dealing with bigger amounts of money.

A Harvard Business School study found that it’s easier for people to save money when they receive big lump sums, because this income isn’t perceived in the same way as regular salary income. It’s viewed as a windfall of sorts, making it easier for people to take that extra money and be more prudent and deliberate about using it to pay down debt, save or invest.

A big part of why we started Keep was to reimagine compensation and retention for employers with Keep vesting cash bonuses – to give individuals access to “chunks” of money that can be used to dramatically accelerate their financial goals.

From paying down credit cards or student debt to starting an emergency fund or investing in retirement, we’re determined to help people understand and create long-term wealth.

Learn more about Keep and how we can help you accelerate your financial goals at keepfinancial.com