TLDR: If annual bonus compensation is misaligned with performance, it will hurt your business. This misalignment can destroy the motivation to perform and then cause serious injury to your corporate culture. Don’t fret though, there’s something simple you can do to address this issue.

***********

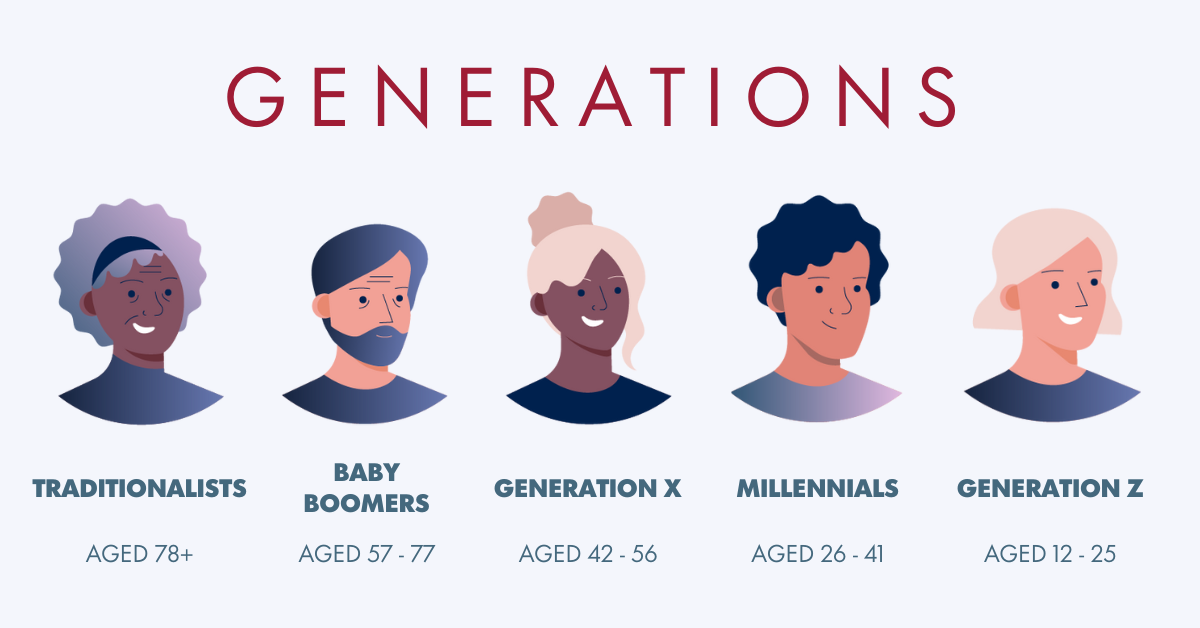

Annual bonuses have long been a staple in corporate compensation packages, serving as a motivator for employees to strive for excellence, contribute to the company's success and to, supposedly, help your employer meet its annual goals. In fact, more than 1/3 of all US businesses offer year-end bonuses today. However, a critical examination reveals a significant disconnect between the intended purpose of these bonuses and their actual impact on both individual and company performance.

One study from management advisers Willis Towers Watson found that more than 25% of companies pay bonuses to employees even when they fail to meet expectations. And, in our recent survey of 404 executives, 80% said that while OKR activities positively impact employee performance, 60% of respondents felt that employee performance was not well-aligned with the bonus given.

Even annual bonuses that fairly matched the performance of an employee are often wrought with issues - they might align with performance but failed to create a performance focused atmosphere. Make no mistake: annual bonuses are not only supposed to align with individual and corporate performance but they’re actually supposed to motivate employees to perform. Had your bonus achieved the purpose intended, you may have exceeded your annual performance and employees could have received an even higher bonus. That would, of course, be a better outcome for everyone. So what is the disconnect? And can it be fixed? (spoiler alert: YES!)

For most employees, their annual bonus is a critical part of overall compensation and is often taken into account when they build their household’s annual budget. Most bonuses range from a low of 5% of base salary to as much as 100% of base salary. Given both the importance of the annual bonus to the employee and the potential impact on the company’s annual plan, you have to get this right. And because annual bonuses are so critical to employees, you have an opportunity to ensure that the bonus absolutely motivates the performance you need.

The financial implications of any misalignment are staggering, costing companies untold billions of dollars. Handing out bonuses that fail to accurately reflect individual and corporate achievements and/or don’t motivate employees in the first place not only undermines the incentive structure but also perpetuates a culture of mediocrity.

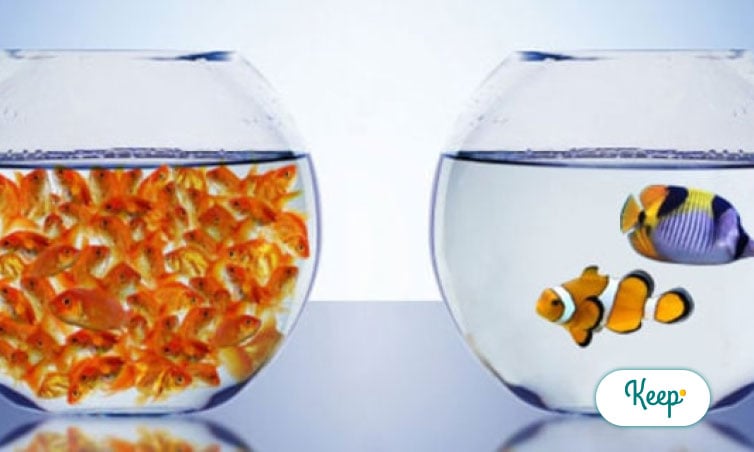

There’s no easier way to disrupt the culture of your company than for your employees to think their work has little to do with their compensation. It’s even more demotivating to realize that they worked hard and performed well, but received the same bonus amount as everyone else. If employees perceive they were underpaid, you’ll destroy their work ethic and commitment. If they perceive they were overpaid, guess what, you’ll perpetuate their underperformance. You lose either way.

Any misalignment erodes trust and commitment and can lead to decreased job satisfaction, increased turnover, and a diminished sense of loyalty to the organization.

Employees who receive bonuses or other regular rewards are 8X more engaged - and how these bonuses are delivered has an impact as well. Compared to the 47% who prefer one yearly bonus, 53% of employees prefer more interim bonuses (e.g., monthly) bonuses over yearly bonuses. Why? Because they’ve already included the amount they anticipate receiving in their family’s budget! Therefore, if they receive more regular amounts, they can avoid high-cost intermediate solutions - such as personal loans.

Our Recommendations

To address the annual bonus conundrum, we recommend two things:

- An audit of your annual bonus system. By evaluating (a) the delta between company and individual performance with actual bonus amounts, and (b) whether the bonus opportunity actually impacted performance during the year, companies can identify gaps and missed opportunities for refinement. Many boards view annual bonus audits as a fiduciary responsibility given the impact that heightened performance can have on a company’s bottom line.

- Based on the outcome of the audit, likely a modification to your bonus program to better align performance with actual payments. Keep has designed an annual bonus approach that enables employers to set up shorter (e.g., quarterly), more objective performance goals together with a shorter term payout of the bonus. However, the bonus is still set to vest on the traditional payout date for annual bonuses (typically Feb 15 or March 1st). This approach has multiple benefits: (a) a series of shorter term goals organized to over-achieve the annual plan, (b) a vesting date to ensure that employees do not leave the company after one of the shorter term payouts, (c) assuming that this approach is used for subsequent years, a decrease in typical attrition after the vesting period as another payment will be made shortly thereafter, and (d) tax and accounting efficiency as expenses are not booked until vesting occurs.

Our annual bonus audit is a simple, typically 2 to 3-day process with the company. It analyzes the existing bonus structure, compares it to individual and company performance, and identifies areas for improvement. By undertaking this proactive measure, companies can develop a go-forward plan that ensures bonuses are aligned with achievements, fostering a culture of fairness and transparency.

We invite companies to take a proactive step toward addressing their annual bonus shortcomings.

Sign up for a complimentary bonus audit at KeepFinancial.com/annual-bonus and embark on a journey to optimize your compensation. By managing annual bonuses effectively and responsibly, companies can enhance employee satisfaction, motivation, and, ultimately, their own success.