-

Why Keep?

Why Keep

-

Employers

-

Employees

-

- Solutions

- Resources

- About Us

For Employees Keep Benefits

Get access to cash now and rewarded over time with a vesting bonus from Keep.

Keep gives you early access to the full amount of a bonus arranged by your employer. At each vesting milestone the portion that vests is no longer required to be paid back should your employment end.

Vesting bonuses from Keep provide financial freedom and flexibility.

You can access 100% of your Keep bonus up front. At each vesting milestone, the portion that vests is no longer owed by you.

Employers are investing in your future – enabling you to achieve personal financial goals, such as:

- Investing

- Making a home down payment

- Paying down student debt

- Paying bills

- Anything you wish, it’s your money

How Vesting Bonuses Work

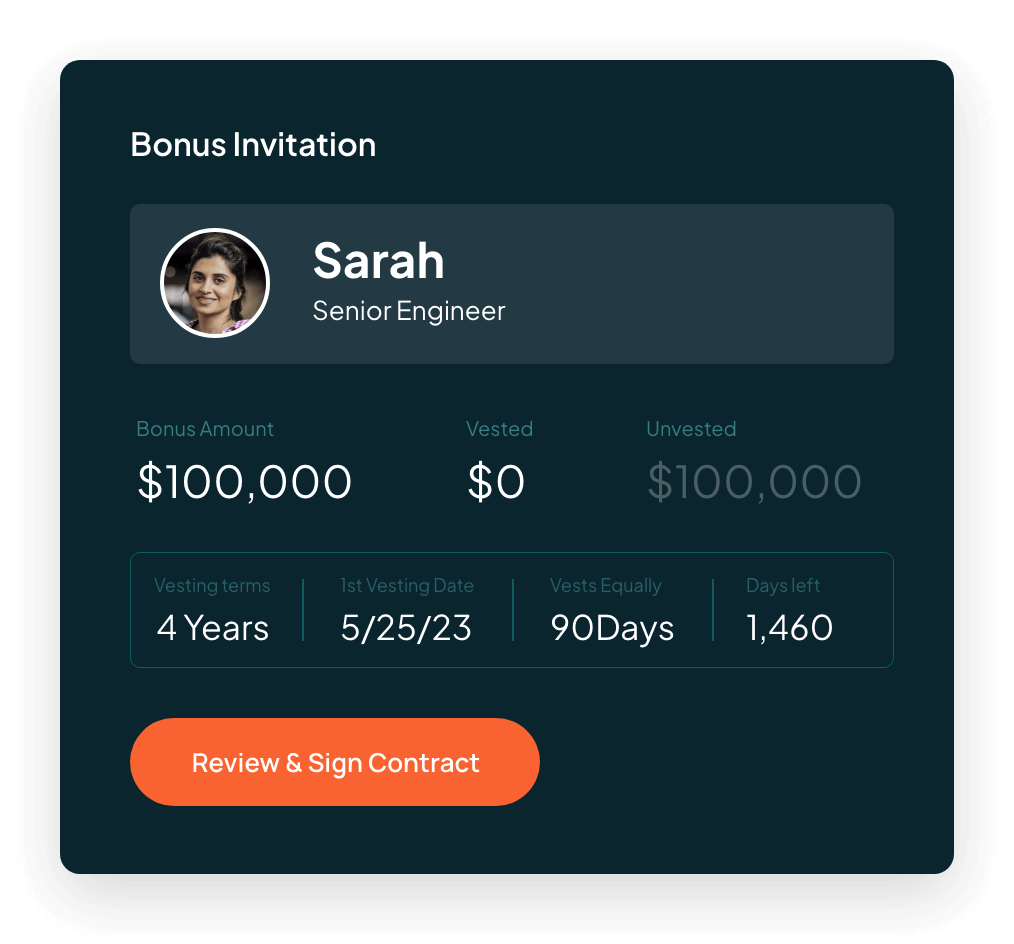

Receives a vesting bonus through Keep from her employer

Sarah receives a Keep bonus, which enables her to access the funds immediately – she reviews the terms. She understands that her custom vesting bonus vests over time and at each vesting milestone, she is no longer required to pay that portion of the money she received should she leave the company.

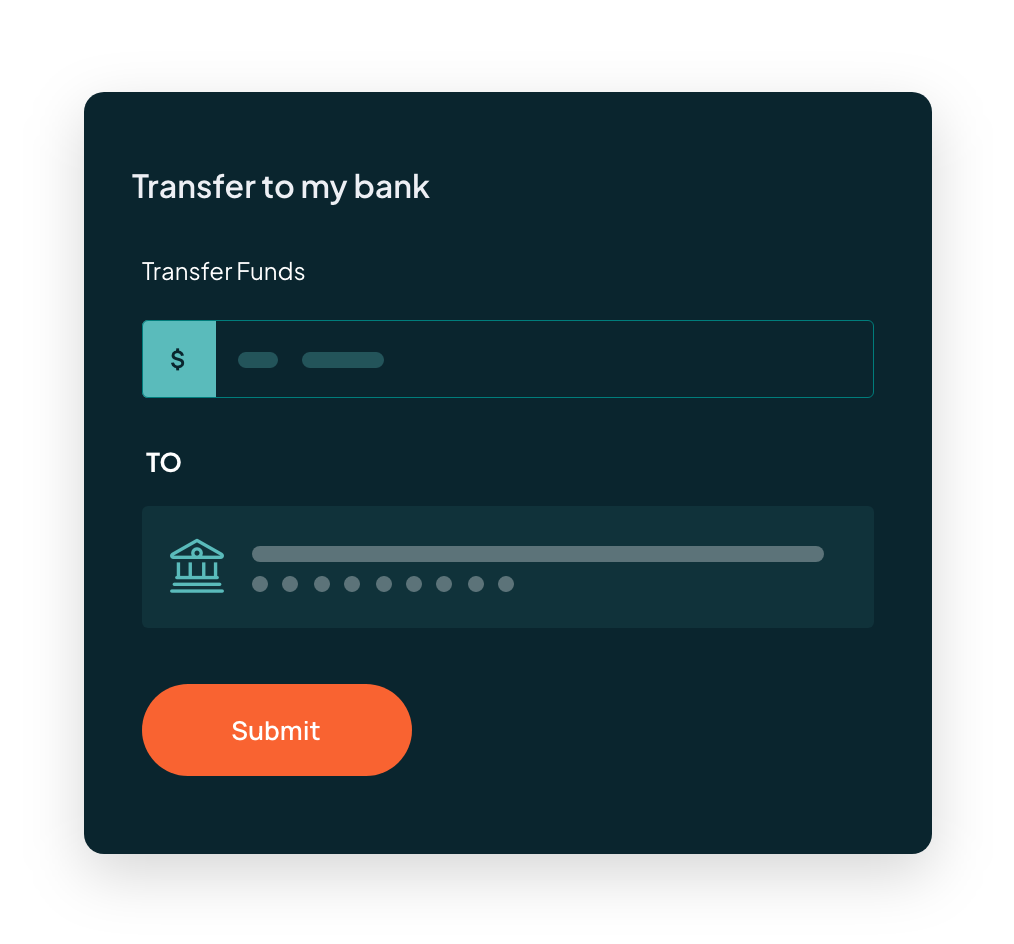

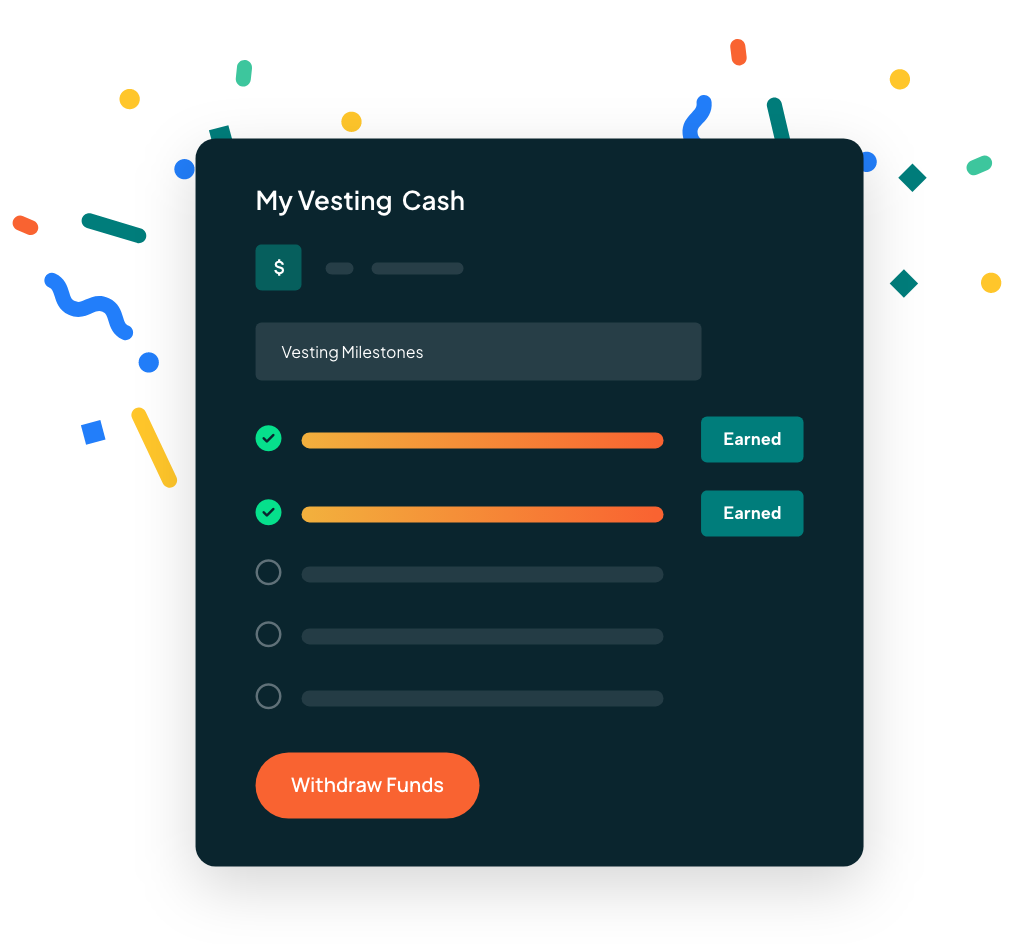

Withdraw Funds

Sarah likes the flexibility of accessing the money up front and she withdraws the funds. She invests a portion, pays down student loans, and takes a trip.

Vesting Milestones Hit

Time passes and Sarah continue to excel at her job. At each milestone, the portion that vests is no longer owed by Sarah. Sarah gets excited when she hits each vesting milestone. At the end of her vesting schedule, her bonus has been paid off entirely by her employer, she’s invested in her future, and Sarah doesn’t owe a dime.

Features

Keep Financial makes it easy to track your vesting cash milestones and manage your money.

Track Vesting

Considered a bargaining chip, traditional signing bonuses don’t support future employee retention, morale, or engagement.

Withdraw Funds

Withdraw any amount of the full vesting cash plan whenever you want. Invest, put a downpayment on a home, take a trip. Whatever you like.

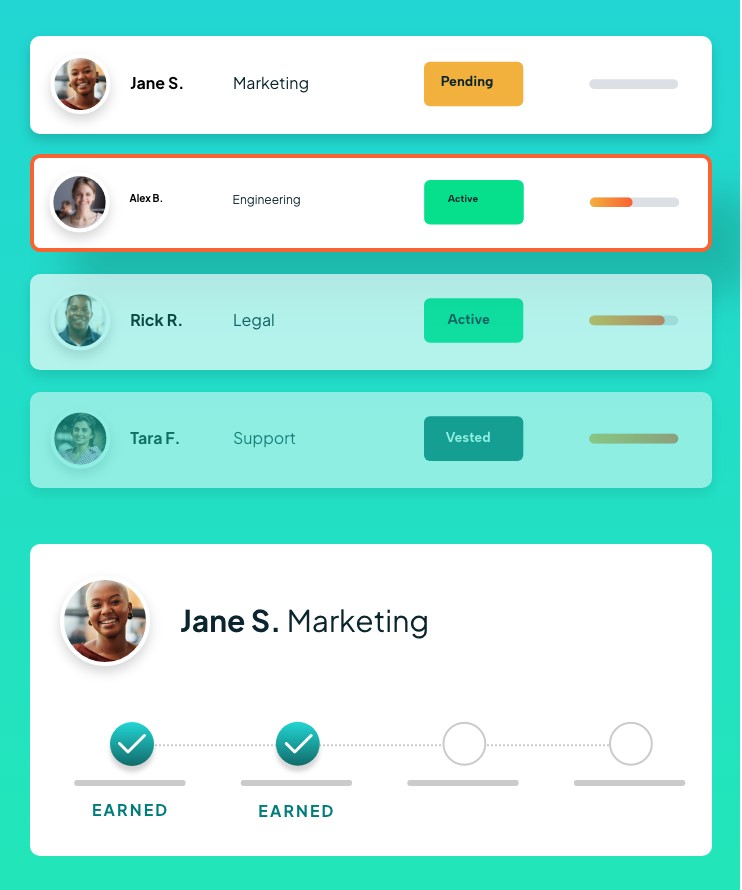

Manage Multiple Bonuses

Your employer may give you multiple vesting cash bonuses with different vesting periods. Easily track vesting milestones of each of your plans.

Stress-Free Structure

Your vesting cash bonus is structured as a 0% interest loan. At each milestone the portion that vests is no longer owed.

Milestone Nofitications

Keep notifies you via email address when you hit these milestones so you don’t need to stay on top of tracking them.

Questions?

We’ve got answers.

We are here to answer any questions you may have. Please refer to some of our most commonly asked questions. Didn’t find what you were looking for? No problem. Visit our help center or contact our friendly Keep team.

Employer test-test

Can I transfer the funds to my bank?

Yes. After receiving a signed agreement between employee and employer, Keep will complete any regulatory review required, ensure that your employer is current on its obligations with Keep, and fund your loan within 1-2 days thereafter. We will notify you when we have initiated funding. Keep Vesting Cash Plan funds can be transferred to your bank account once this process is completed.

What happens if I leave the company?

If you have withdrawn more cash than has vested at the date of your departure from your company, you are legally required to pay back the total remaining balance on your vesting schedule. There is a 60 to 120-day repayment period at 0% interest before the loan converts into a 1 or 3 year interested-bearing loan, divided into monthly payments.

Why is this called a 0% interest loan?

Keep Cash Plans are structured as loans in order to facilitate the vesting process, and in the event of early employee exits, the collections process. However, these loans are offered at 0% interest during your tenure at your company and are fully prepaid by your employer.

Can I spend money that hasn’t vested?

Yes. Once your Keep Vesting Cash Plan has been signed by both parties, you can access 100% of your available funds.

What should I do with the money?

The cash is yours to allocate however you see fit. Alleviate any financial stressors, make a down payment, invest, or more. The possibilities are limitless.

Does the loan have an interest rate?

During your tenure at the company that offered you the Keep Vesting Cash Plan, your loan will have a 0% interest rate. If you leave the company before your plan fully vests and you have withdrawn more cash than has already vested, you are legally required to pay back the total remaining balance on your vesting schedule. There is a 60 to 120-day repayment period at 0% interest before the loan converts to a 1 or 3 year interest-bearing loan, divided into monthly payments.

How do taxes work?

You will not be taxed on the loan you receive from Keep. However, when your employer prepays this loan (on each of your vesting dates), you will be taxed for the amount that has vested.