Keep Financial survey shows 44% of employees say primary use of cash bonus would be to pay off debt

ATLANTA, Georgia – January 18, 2023 – Today, Keep Financial released its Effective Compensation Survey Report which found that 86% of employees would take an extra cash bonus in exchange for time commitment at their company. In addition, of those respondents who receive stock options or other equity, 76% say they would rather receive all or a portion of that equity as cash today in exchange for a time commitment. As companies look beyond traditional compensation for creative ways to recruit and retain employees, survey research shows that cash is preferred.

The survey report comes from an online poll by Keep Financial in December 2022 of 1,027 full-time US employees, ages 18 and up. Respondents work across a range of industries, including finance, healthcare, technology, education, retail, government, and manufacturing. Keep Financial’s flagship product enables employers to issue cash compensation that has a vesting component embedded within it.

“The survey shows us that cash is king for employees – and comes right as many companies seek to revamp compensation and retention strategies,” said Rob Frohwein, Keep Financial Co-Founder and CEO. “However, for employers to be effective in meeting employees’ needs, they must also ensure that the corporate object of retention is met. Keep ensures that outcome.”

Today’s employers have the opportunity to offer innovative compensation packages that deliver retention of top employees while helping them reach both short and long-term financial goals. The report explores how employees would view a lump sum cash bonus tied to retention, how they would use that cash and how it compares to other incentives, such as stock options or other equity.

Key survey highlights include:

- Cash is king – 86% of respondents would take an extra lump sum cash bonus in exchange for agreeing to stay with their company for a specific period of time.

- Paying off debt is priority – When asked how they would use a lump sum cash bonus payment, respondents listed paying off debt (44%), saving for retirement (40%), starting an emergency fund (28%) and saving for a down payment on a home (21%) as the priorities.

- Cash preferred over stock options – 33% of respondents say they receive stock options or other equity as part of their compensation. But of those receiving equity, 76% said they would rather receive all or a portion of that as a lump sum of cash today in exchange for staying at the company for a certain period of time.

The results prove that upfront cash bonuses are a desirable benefit that can give companies a competitive edge when recruiting or retaining key employees. This feedback comes at a critical time, as McKinsey found that people are voluntarily leaving their jobs at a 25% higher rate than they were pre-pandemic. In today’s competitive market, employers must listen to the needs of the workforce and focus on offering flexible compensation plans designed to help employees achieve their personal financial goals.

“Compensation options have been static for decades. As employees increasingly grapple with student debt, increasing housing costs and inflation, companies have an opportunity to get cash-creative to help employees grow their net worth while ensuring they retain their best workers to boost productivity and the bottom line,” added Frohwein.

Download the full survey report at: keepfinancial.com/effective-compensation-survey-report-2023

About Keep Financial Technologies, Inc.

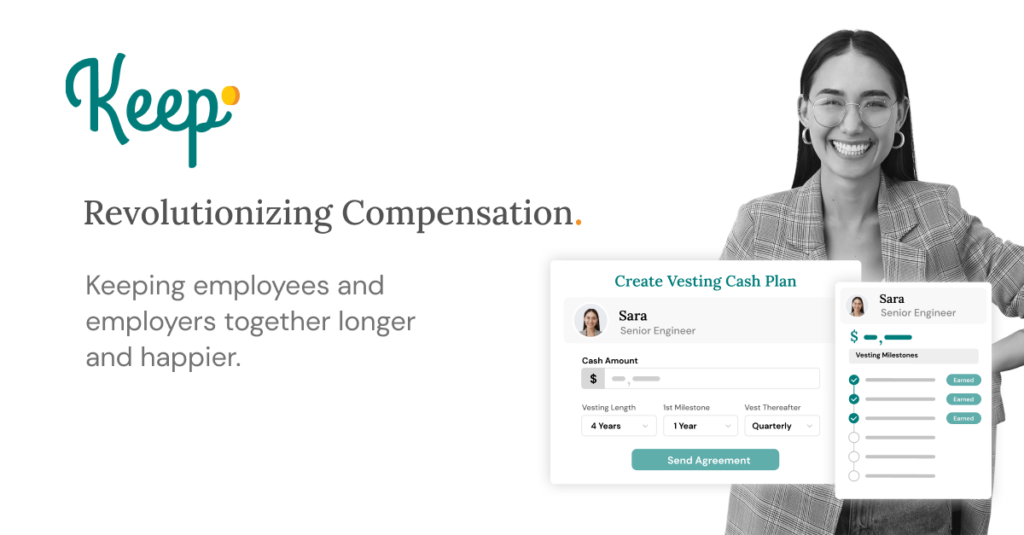

Keep Financial is revolutionizing compensation to directly improve recruiting, retention, and performance – aligning compensation with business objectives and ROI. Through the intuitive Keep™ Employee Engagement Platform (KEEP), employers can create and track customizable Vesting Cash Plans to deliver bonuses and incentives that attract top talent, assure retention, and increase overall employee morale and productivity. KEEP takes compensation to an entirely new level – providing employees with usable capital up front to satisfy personal goals while securing businesses’ long-term success. Keep Financial is backed by Andreessen Horowitz, Launchpad Capital, Thomvest Ventures, Cambrian Ventures, and Worklife Ventures.

To learn more about Keep and start attracting and retaining top talent today, visit keepfinancial.com

Connect with Keep on Twitter, LinkedIn, Facebook, and YouTube