Recruiting top talent is rarely easy. Finding the right candidate for a role is time-consuming and costly, and getting it wrong could have significant negative impacts across the team. What’s more, today’s market conditions have made an already tricky process even harder, with employee demands increasing and loyalty decreasing. A recent report showed that more than four million U.S. workers resigned each month for twelve consecutive months from mid 2021 through mid 2022. Additionally, as of November, 2022, 44% of U.S. small business owners reported having openings they were unable to fill.

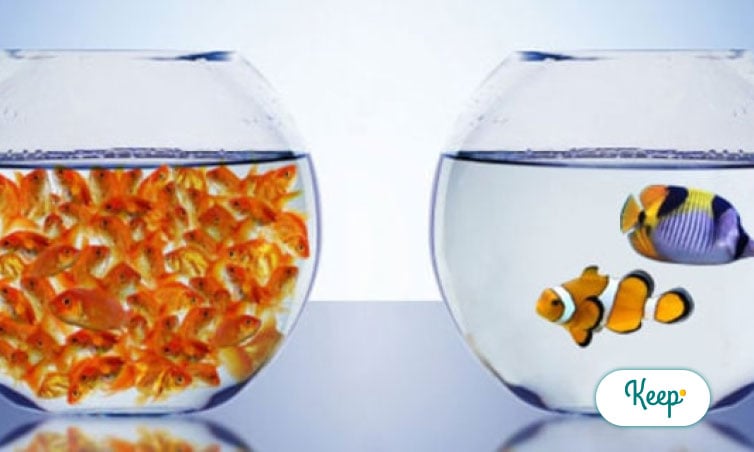

These challenges put an even greater focus on the recruiting process and highlight the importance of crafting attractive compensation packages that outshine the competition. In addition to a competitive salary, many companies have turned to perks like flexible working arrangements, unlimited vacation, gym memberships, and beyond to set themselves apart. In some sectors, equity or stock options have become an increasingly common component of an overall package – one employers often lean on to help close the deal.

The Challenge with Equity

For some, the addition of equity in an offer can provide a sense of ownership – the idea that they’re invested in the company’s success can be attractive and motivating. However, equity as a compensation perk also carries a number of significant challenges, and for many candidates it fails to provide an enticing benefit.

One of the biggest red flags with equity is that it’s never a sure thing. The value of stock options depends completely on the success of the organization, and there’s no guaranteeing that a company will follow its projected path. A number of issues – changing market demands, economic declines, internal challenges, etc. – could derail a company’s roadmap and effectively devalue any equity an employee is rewarded. Additionally, variability and fluctuations in the stock market play a tremendous role in the overall value of an equity package and make it hard to pin down, which increases the complexity and ambiguity of the offer.

Adding to this uncertainty is the fact that it’s often unclear when equity might lead to a payout. This depends largely on a company’s maturity and projected trajectory, and timelines are never set in stone. For many, the need to wait an unspecified amount of time for an unspecified amount of money doesn’t offer much incentive to stick with a company. This lack of guarantee is often not enough for job hunters in today’s increasingly competitive space.

The Power of Cash Incentives

Cash coupled with retention offers an attractive alternative to equity by providing the certainty of an immediate payout. When included in an offer, vesting cash bonuses are awarded at the outset of employment in exchange for agreement to stay with the company for a specified period of time. Throughout that period, there are key vesting milestones where a portion of the bonus vests and is no longer required to be paid back if employment ends. Unlike equity, vesting cash provides fast access to funds that could have a life-changing impact for workers, allowing them to pay off student debt, put a down payment on a home, start a retirement fund, and ultimately build overall net worth.

There is no question that today’s economic conditions are challenging for many of us. With home prices on the rise and inflation impacting everyone’s bottom line, the addition of a lump sum cash bonus in a job offer provides a helpful cushion and much needed financial peace of mind during a turbulent time.

A recent Keep Financial survey revealed that of those who currently receive equity, 76% would rather receive all or a portion of that equity as a lump sum of cash, in exchange for staying with the company for a certain period. With more than three-fourths of respondents favoring cash, there’s no denying that the lump sum bonus carries significant weight and is an attractive incentive.

It’s not just employees who stand to gain from cash bonus options. Companies also benefit by having an extra chip on the table when it comes to recruiting, as well as the ability to retain employees longer. Employee loss can be incredibly disruptive to team productivity, and recruiting carries significant time and financial costs, not to mention the training investment needed to get new team members up to speed. Vesting cash bonuses are a powerful tool to thwart poaching and extend employee tenure, which carries significant financial and productivity benefits.

Indeed, many businesses, including household names like Tesla, have already seen the value in cash bonuses and are implementing them as an incentive. For companies looking to differentiate themselves, it’s time to listen to employee needs and make offers that can help workers take real steps forward in achieving their financial goals. Vesting cash provides a way for employees to build net worth and employers to build the teams they need to succeed.

Are you ready to learn more? Schedule a Keep Financial demo today.